Summary

While impact investing is not a new phenomenon, due to a variety of influences it is now reaching a new level of visibility and influence, drawing new entrants and being established in the mainstream of investment practices. Impact investing, however evolved from its earliest days, remains nascent and difficult to assess with real clarity, with the real definition of “impact” yet to be established. For those investors with the willingness and capacity to engage in impact investing, it is ultimately more rewarding and necessary in our quest for a sustainable economy.

Impact investing, defined by the Global Impact Investing Network (GIIN) as “investments made into companies, organizations, and funds with the intention to generate social and environmental impact alongside a financial return,”1 is not new. With origins in faith-based and socially responsible investment screening, the South African divestment movement, and community development financial institutions in the last century, impact investing is now reaching a new level of visibility and influence.

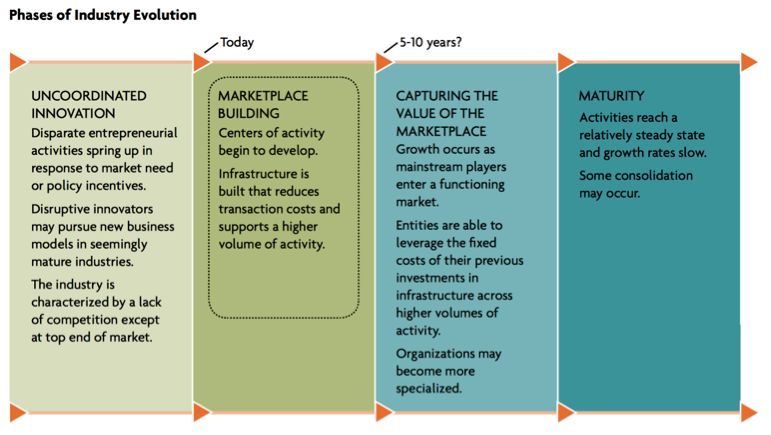

This investing approach experienced a watershed moment in 2007 when the term “impact investing” was coined at a meeting hosted by The Rockefeller Foundation. The subsequent 2009 Monitor Institute report, “Investing for Social and Environmental Impact: A Design for Catalyzing and Emerging Industry,” assessed the state of the field, and a roadmap for building the industry.2 As noted in Figure 1, in 2009 the industry was deemed to be emerging from a state of “uncoordinated innovation,” and entering into the “marketplace building” phase, where investments in infrastructure help to support more efficient activity. The report suggested that with the support of such efforts, the industry could reach the “value capture” phase in five to ten years, characterized by mainstream entrants into the marketplace, higher volumes of activity, and increasing specialization. Seven years later we are indeed seeing signs of industry progress.

Figure 1: Monitor Institute’s 2009 Industry Status Assessment

Source: Monitor Institute, “Investing for Social and Environmental Impact: A Design for Catalyzing and Emerging Industry,” January 2009. http://monitorinstitute.com/downloads/what-we-think/impact-investing/Impact_Investing.pdf

Mainstream entrants

Still seen as a “fringe” approach ten years ago, with nonprofits and boutique firms leading the work, the last several years have been notable in the increase of mainstream entrants into the industry. Most major financial institutions now have impact investing groups in addition to their traditional CRA-driven community development finance teams. In 2015, Goldman Sachs acquired Imprint Capital Advisors, an impact investing-focused asset management firm.3 In August of 2016, Bain Capital launched its Double Impact Fund, led by Governor Deval Patrick, to invest in mission-driven middle-market companies addressing sustainability, health and wellness, and community building themes.4

The entrance of these mainstream players indicates that they are experiencing client demand and perceiving growing investment opportunities in the space. A critical element driving this evolution is the rising influence of women and millennials on the capital markets. Women control more than $20 trillion in consumer spending,5 and over the next 30 years $30 trillion in assets will be transferred to the next generation. These demographic shifts are significant, as both women and millennials are more likely to want their investments to reflect their values and do not perceive that wealth-building and positive community impact must be bifurcated.6,7

Another critical factor encouraging new entrants is the alleviation of regulatory concerns held by pension fund and foundation asset managers that constrained their engagement in impact investing. In October 2015, the Department of Labor issued new guidance stating that, “all other factors being equal it’s perfectly acceptable for ERISA plan fiduciaries to consider the social impact of their investments.”8 In April of 2016, the Department of the Treasury issued new guidance for foundations on program-related investing that helped to alleviate perceived excise tax risks associated with making impact investments.9 Both of these announcements should help to lower the bar for pension fund and foundation capital.

Higher volumes of activity

A comprehensive assessment of the market remains elusive, given its broad geographic and sector reach, so we must rely on indicators. In 2010, J.P Morgan and GIIN began surveying active institutional impact investors to assess the state of the market. While its sample is limited, reviewing its findings over time is an interesting indicator of activity. In 2011, 52 impact investor respondents, all of whom had at least $25 million under management, reported that they planned to employ $3.8 billion in impact investments in the following year.10 In the most recent report, 157 impact investor respondents indicated they had committed $15.2 billion in 7,551 impact investments in 2015, and planned to increase their impact investment commitments by 16 percent to $17.7 billion and the number of deals by 55 percent to 11,722. In aggregate, these respondents are currently managing $77.4 billion in impact investment assets.

While many investors still complain about “investable deal flow” in impact the above numbers indicate a positive trend, and Bain Capital’s entrance clearly indicates a comfort level with promising impact investing opportunities in the private equity space. Investors’ Circle, the early stage impact investing network that I lead, has experienced a 33 percent increase in early-stage company applications for investment, and the number of deals funded through national events has increased over the past five years from 30 to 50 percent of pitching companies, indicating an increase in the quality of investment opportunities along with the quantity.

Beyond the investment numbers, greater activity is also being seen in supporting fields. Social entrepreneurship has reached broader awareness, and business schools are incorporating social entrepreneurship and impact investing into their curricula and offerings to compete for students,11 as 88 percent of MBA students consider learning about social and environmental business to be a priority, according to Net Impact’s 2014 “Business as UNusual” survey.12 The number of social enterprise accelerators has also grown dramatically, with over 60 being identified at a trade group site.13

Increasing specialization

With the increased overall activity and entrants has come increasing specialization. Organizations and firms have emerged to support different investor constituent categories, from asset managers to philanthropists and foundations to ultra high net worth individuals; or to focus on particular asset classes, geographies or impact areas. For entrepreneurs, most impact accelerator programs provide sector-specific cohorts or programming.14 The number of investment sectors reported in the annual GIIN survey has doubled to 14, as asset managers increasingly direct their investments to particular areas of interest.

New themes and interest areas have developed in the past seven years as well. With the entrance of mainstream financial players, many have grown increasingly concerned that impact will be diluted or deemphasized, and underrepresented populations will be left behind. Interest has grown in “gender lens” investing, focused on investments’ impacts on the inclusion, engagement, empowerment and/or enhanced well-being of women and girls. Efforts to increase and ensure access to capital for underrepresented populations and to promote broader wealth-building impacts have also emerged.15, 16

What is next?

Clearly the impact investing field has made progress towards “capturing the value of the marketplace.” Yet this stage remains fairly “noisy” and difficult to navigate, with some key questions impeding the market’s efficiency.

A persistent challenge is the definition and measurement of “impact,” with its broad scope and cross-sector applicability. Some new entrants struggle to engage when they do not understand what impact is, some industry pioneers fear mainstreaming will dilute impact to the point of being meaningless, and others are concerned that too strict a definition will limit this marketplace’s influence, keeping it niche and limiting its transformative influence on business.

This broad scope also impairs the ability to size and benchmark the market and returns. The market has a diversity of investment theses and return expectations, ranging from market-rate or above returns to concessionary returns in line with deep impact. More tools are needed to help new entrants assess the range of investment opportunities and returns available in their areas of impact interest.

Although sometimes frustrating, working through these market development challenges is a critical and worthy endeavor. In this age of greater customer expectation and transparency, it is folly to believe that one can grow a successful, long-term business oblivious to social and environmental externalities. Incorporating impact into one’s investment considerations is indeed a more complex approach, but it is ultimately more rewarding and necessary in our quest for a sustainable economy.

References

1. “What You Need to Know About Impact Investing,” Global Impact Investing Network, accessed October 16, 2016, https://thegiin.org/impact-investing/.

2. “Investing for Social and Environmental Impact,” The Monitor Institute (January 2009), accessed October 16, 2016, http://monitorinstitute.com/downloads/what-we-think/impact-investing/Impact_Investing.pdf.

3. Michael J. Moore, “Goldman Sachs Agrees to Buy Asset Manager Imprint Capital,” Bloomberg (July 13, 2015), accessed October 16, 2016, http://www.bloomberg.com/news/articles/2015-07-13/goldman-sachs-agrees-to-acquire-asset-manager-imprint-capital.

4. Chris Witkowsky, “Bain Launches Impact-Investing Fund Led by Ex-Gov. Patrick,” Buyouts (August 1, 2016), accessed October 16, 2016, https://www.pehub.com/buyouts/bains-impact-investing-business-led-by-former-massachusetts-governor-launches-fund/.

5. Michael J. Silverstein and Kate Sayre, “The Female Economy,” Harvard Business Review (September 2009), accessed October 16, 2016, https://hbr.org/2009/09/the-female-economy.

6. “Millennial Investors Want Their Wealth to Help Others, Lack Confidence Managing Finances,” SpectrumGroup, accessed October 16, 2016, http://spectrem.com/Content_Press/May-28-2013-Press-Release.aspx.

7. Jed Emerson and Lindsay Norcott, “Millennials Will Bring Impact Investing Mainstream,” Stanford Social Innovation Review (April 24, 2014), accessed October 16, 2016, https://ssir.org/articles/entry/millennials_will_bring_impact_investing_mainstream.

8. Bernice Napach, “DOL Clears Way for Impact Investing in Retirement Plans, ThinkAdvisor (October 22, 2015), accessed October 16, 2016, http://www.thinkadvisor.com/2015/10/22/dol-clears-way-for-impact-investing-in-retirement.

9. May Harris and Linda Rosenthal, “Private Foundations: New Program-Related Investments Guidance,” For Purpose Law Group, accessed October 16, 2016, http://www.forpurposelaw.com/foundations-new-program-related-investments-guidance/.

10. “Insight into the Impact Investment Market: An In-Depth Analysis of Investor Perspectives and Over 2,200 Transactions,” J.P. Morgan (December 14, 2011), accessed October 16, 2016, https://www.jpmorganchase.com/corporate/socialfinance/document/Insight_into_the_Impact_Investment_Market.pdf.

11. Jeanette Brown, “Social Impact and the MBA: Business Schools Where the Two are Synonymous,” Clear Admit (March 18, 2016), accessed October 16, 2016, http://www.clearadmit.com/2016/03/social-impact-mba-business-schools-two-synonymous/.

12. “Business as Unusual,” Net Impact, accessed October 16, 2016, https://www.netimpact.org/business-as-unusual?src=hp-tri-2.

13. “Accelerating the Accelerators,” Convenors.org, accessed October 16, 2016, http://conveners.org/ata-programs/.

14. Search Results, Enable Impact, accessed October 16, 2016, http://search.enableimpact.com/search/faceted?search_for=Accelerator.

15. Neighborhood Economics, accessed October 16, 2016, http://neighborhoodeconomics.org.

16. Transform Finance, accessed October 16, 2016, http://transformfinance.org.

Author Bio

Bonny Moellenbrock is the Executive Director of both Investors’ Circle and SJF Institute and brings extensive entrepreneurial, venture capital, sustainable business, and nonprofit management experience to her role. Previously, Bonny was a Managing Director at SJF Ventures, a leading impact venture fund investing in high-growth, positive impact companies in the cleantech, sustainability, and technology-enhanced services sectors. Before joining SFJ in 2000, she served as COO and CFO of Preservation North Carolina, a nonproft that promotes historic preservation and protects properties through its award-winning endangered properties acquisition and redevelopment program. She also served as VP of Administration for Orange Recycling Services, an entrepreneurial commercial recycling company. Bonny serves on the GIIRS Developed Markets Standards Advisory Council, the Advisory Board of AMCREF Community Capital, and the Board of Trustees of the Resource Center for Women and Ministry in the South. Bonny holds an MBA, a Masters of Regional Planning, and a BA in Environmental Policy from the University of North Carolina at Chapel Hill, and is a graduate of the Venture Capital Institute. She enjoys gardening and making music with her husband and two daughters at their historic bungalow in Durham, NC.