No nonprofit has a mission statement focused on managing an efficient office. You don’t start a nonprofit because you’re zealous about accounting, HR laws or where you buy paper clips; nonprofits are founded to fulfill a need in the community and serve the public interest. But then there is the business of nonprofits. There are paperwork, vendor management and millions of other little things that any small organization must deal with regardless of their mission.

Most nonprofits never rise to the scale of having a full internal administrative staff and purchased equipment. They rely on a slew of vendors for services, equipment and more, but their small scale puts them at a disadvantage at the negotiating table.

In the for-profit world, the business process outsource industry covers nearly every imaginable administrative service, and Professional Employer Organizations (PEOs) are now an entire outsourcing sector that covers all HR matters. These industries provide small businesses with solutions for their common problem: how does a small organization realize an economy of scale without having the scale required?

On the nonprofit side, there are very few organizations that provide comparable services. These operational services are often provided by membership-based groups or fiscal sponsors commonly called “shared- service organizations.” These organizations offer an economy of scale that they open up to other organizations, providing operational support at a price point that is more affordable than doing it internally. This allows a smaller nonprofit more flexibility in their budget to put more money in their mission.

The Benefits of Shared-Service Organizations

The above common issues are the reason that shared-service organizations have become a popular choice for new and established nonprofits to turn to for expertise and cost savings. The many costs of running any type of business, be it an LLC or a 501c3, are quite similar. While they may have different funding sources, products or services to provide, they all have to manage money, equipment and staff.

This is where shared-service organizations can be a huge benefit for nonprofits looking to realize cost savings without compromising their level of programming. Organizations like the Urban Affairs Coalition (UAC) in Philadelphia and other founding members of the National Network of Fiscal Sponsors (NNFS) focus on providing shared-services. While any nonprofit can share services with another, members of the NNFS— Community Partners, Colorado Nonprofit Development Center, Earth Island Institute, PHFE Management Solutions, Community Initiatives, Third Sector New England and Tides—focus specifically on providing shared services at the highest standard.

For example, UAC’s HR and fiscal services departments have a staff of 18, with specialists in nonprofit accounting, HR, benefits management, grant reporting, government contracts, payroll and cash management. Organizations that use UAC’s shared services have an assigned accountant, cloud-based online budget and accounting software, a controller and a full C-suite to consult with, as well as other capacity building services—networks that individual organizations would find much costlier. UAC has reached its economy of scale over the last 40 years. With a collective budget of over $25M, 75+ organizations and 400 employees, UAC is able, as a single entity, to negotiate with all of its vendors at a scale and create savings that the individual 75 organizations would be hard pressed to be able to do independently. As more organizations partner with a shared-service organization, that shared-service organization’s economy of scale grows and its clients can further shift more dollars to programming.

There are many ways that an organization can find administrative savings without joining a member-based or shared-service organization. Sometimes you just see who your neighbors are to find natural partners.

No nonprofit has a mission statement focused on managing an efficient office. You don’t start a nonprofit because you’re zealous about accounting, HR laws or where you buy paper clips; nonprofits are founded to fulfill a need in the community and serve the public interest. But then there is the business of nonprofits. There are paperwork, vendor management and millions of other little things that any small organization must deal with regardless of their mission.

Most nonprofits never rise to the scale of having a full internal administrative staff and purchased equipment. They rely on a slew of vendors for services, equipment and more, but their small scale puts them at a disadvantage at the negotiating table.

In the for-profit world, the business process outsource industry covers nearly every imaginable administrative service, and Professional Employer Organizations (PEOs) are now an entire outsourcing sector that covers all HR matters. These industries provide small businesses with solutions for their common problem: how does a small organization realize an economy of scale without having the scale required?

On the nonprofit side, there are very few organizations that provide comparable services. These operational services are often provided by membership-based groups or fiscal sponsors commonly called “shared- service organizations.” These organizations offer an economy of scale that they open up to other organizations, providing operational support at a price point that is more affordable than doing it internally. This allows a smaller nonprofit more flexibility in their budget to put more money in their mission.

The Benefits of Shared-Service Organizations

The above common issues are the reason that shared-service organizations have become a popular choice for new and established nonprofits to turn to for expertise and cost savings. The many costs of running any type of business, be it an LLC or a 501c3, are quite similar. While they may have different funding sources, products or services to provide, they all have to manage money, equipment and staff.

This is where shared-service organizations can be a huge benefit for nonprofits looking to realize cost savings without compromising their level of programming. Organizations like the Urban Affairs Coalition (UAC) in Philadelphia and other founding members of the National Network of Fiscal Sponsors (NNFS) focus on providing shared-services. While any nonprofit can share services with another, members of the NNFS— Community Partners, Colorado Nonprofit Development Center, Earth Island Institute, PHFE Management Solutions, Community Initiatives, Third Sector New England and Tides—focus specifically on providing shared services at the highest standard.

For example, UAC’s HR and fiscal services departments have a staff of 18, with specialists in nonprofit accounting, HR, benefits management, grant reporting, government contracts, payroll and cash management. Organizations that use UAC’s shared services have an assigned accountant, cloud-based online budget and accounting software, a controller and a full C-suite to consult with, as well as other capacity building services—networks that individual organizations would find much costlier. UAC has reached its economy of scale over the last 40 years. With a collective budget of over $25M, 75+ organizations and 400 employees, UAC is able, as a single entity, to negotiate with all of its vendors at a scale and create savings that the individual 75 organizations would be hard pressed to be able to do independently. As more organizations partner with a shared-service organization, that shared-service organization’s economy of scale grows and its clients can further shift more dollars to programming.

There are many ways that an organization can find administrative savings without joining a member-based or shared-service organization. Sometimes you just see who your neighbors are to find natural partners.

Leveraging Organic Co-location

There are many reasons that nonprofits tend to cluster. Often, it stems from multiple needs in a targeted location, but sometimes its comes down to the rent. There are several buildings in Center City Philadelphia that tend to attract nonprofit organizations for a number of reasons. One of these buildings is 1315 Walnut Street; a quick search on Guidestar.com pulled over 26 nonprofits including:

- The Juvenile Law Center

- The Women’s Business Development Center

- The Energy Co-op

- Girls, Inc.

- Children’s Aid Society

- Bread and Roses Community Fund

- Ten Thousand Friends of PA

- Greater Philadelphia Federation

- Tenant Action Group

- Cultureworks

- Fair Foods Philly

While these tenants vary widely in mission, scale and size, they have more in common than a set of elevators. They all have the common need for basic business services, equipment and administrative staff. Collectively, these 26 organizations represent several million dollars a year in administrative costs; this includes the basics like utilities, Internet, office supplies, printer/copier, healthcare, an office manager, a bookkeeper and an accountant.

It raises some questions: could several organizations on the same floor share a single printer/copier, office supply vendor or office manager? How many hidden efficiencies in this building alone could create an economy of scale where these organizations would realize a level of savings that allowed them to increase their programming output efficiency?

Look at your organization’s location. Are there other organizations located nearby with which you could co-locate and potentially share services? Is your target population participating with other nonprofit organizations? Could you co-serve them?

Should You Partner with a Shared-Services Organization?

The principal reason to join a shared-service organization is economic. Each shared-service organization has a slightly different set of services, expertise and fees. Shared-services fees from fiscal sponsorship organizations can range from 3 to 15% of an organization’s total annual revenue depending on the services rendered. HR services are usually per-employee, per-month or a percentage of total payroll. So it’s important to look at your budget and compare costs to see if your organization will find an economic advantage in contracting with a shared-service organization.

It is important to look at the following:

- Bookkeeping and accounting costs

- HR costs

- Audit costs

- Directors and officers and liability insurance costs

- Health insurance costs

- 403b and other benefit costs

- Consulting costs

- ED time managing the above instead of focusing on the mission

Add up these administrative costs and then calculate them as a percentage of your total budget. If that number is over 10% of your annual budget, it is worth exploring a relationship with a shared-service organization

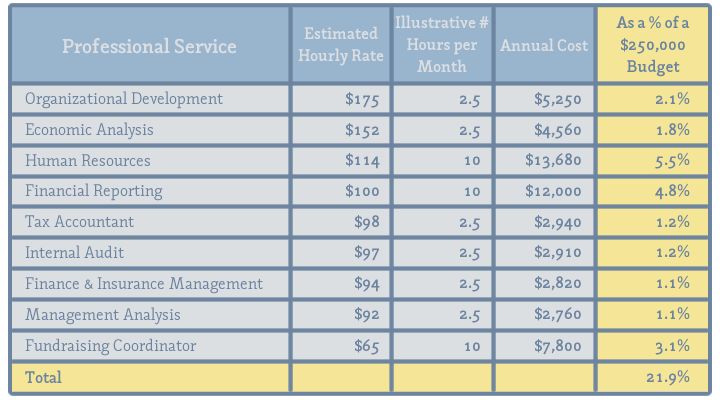

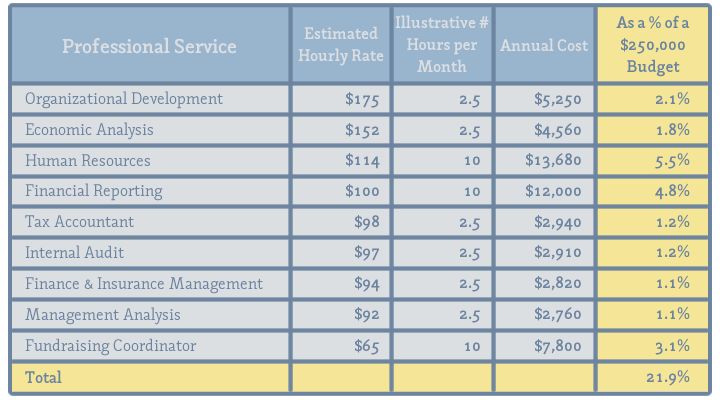

See the below example:

These estimated hourly rates are derived from annual salary averages for industry professionals in the Philadelphia region in each of the selected categories. An overhead rate of 2.5 and 2,000 billable hours per year are assumed.

As you calculate your administrative costs and your board and executive director’s administrative burden, you should also compare experience and decision-making expertise. Who would you be sharing services with? Shared services mean shared responsibilities and legally binding agreements, so when evaluating a shared-service opportunity, you should do your due diligence.

The Scale of the Greater Philadelphia Nonprofit Sector

The five-county Philadelphia region reported $43B+ in revenue from a total of 17,635 nonprofits. It’s commonly estimated that total real nonprofit overhead is 30%, which means that in greater Philadelphia about $13B goes to overhead and back-office operations: There has to be room for savings here. If every nonprofit used shared service and saved 10% in admin costs, we could redirect $1.3B from overhead to programming every year. Imagine that impact.

Citation: Internal Revenue Service, Exempt Organizations Business Master File (2012, Aug)

The Urban Institute, National Center for Charitable Statistics, http://nccsdataweb.urban.org/

Notes: Includes organizations that filed forms 990, 990-EZ, 990-PF and, since 2008, 990-N ePostcard within 24 months of the BMF release date, as reported in NCCS Core Files and IRS Business Master Files.

Organizations based in the U.S. Territories and Puerto Rico and other 'out-of-scope' organizations (see NCCS Data Guide, p.21) are excluded.

Because of many factors in the marketplace of nonprofits, organizations find themselves competing more than cooperating. This dynamic makes shared services and co-locating counterintuitive on the surface, but go back to your mission: Why does your nonprofit exist and how it can best be of service? Finding cost savings has the same impact as getting a cash donation. Can your organization leverage shared services, economies of scale, renegotiation and partnership to shift 1%?

The 1% Challenge

There isn’t an organization on the planet that can’t become 1% more efficient, and there shouldn’t be one that doesn’t try to reduce its costs. If every one of the 17,635 area organizations became 1% more efficient, nearly $130M would be redirected into programming, which would affect countless families and individuals in need. That works out to about $7,000 per organization, no small sum for many. As a leader in Philadelphia’s nonprofit community, you should make one of your operational goals for this year to try to find these hidden efficiencies because, as we all know in Philly, a penny saved is a penny earned.

Author Bio

Tivoni Devor has spent his entire professional career in the nonprofit industry, where he has built a niche generating earned revenue and reducing organizations’ operational expenses. He earned his MBA from Drexel and has recently been certified in barbeque judging and Braille transcription.